Sept 2024 – A Property Market Review

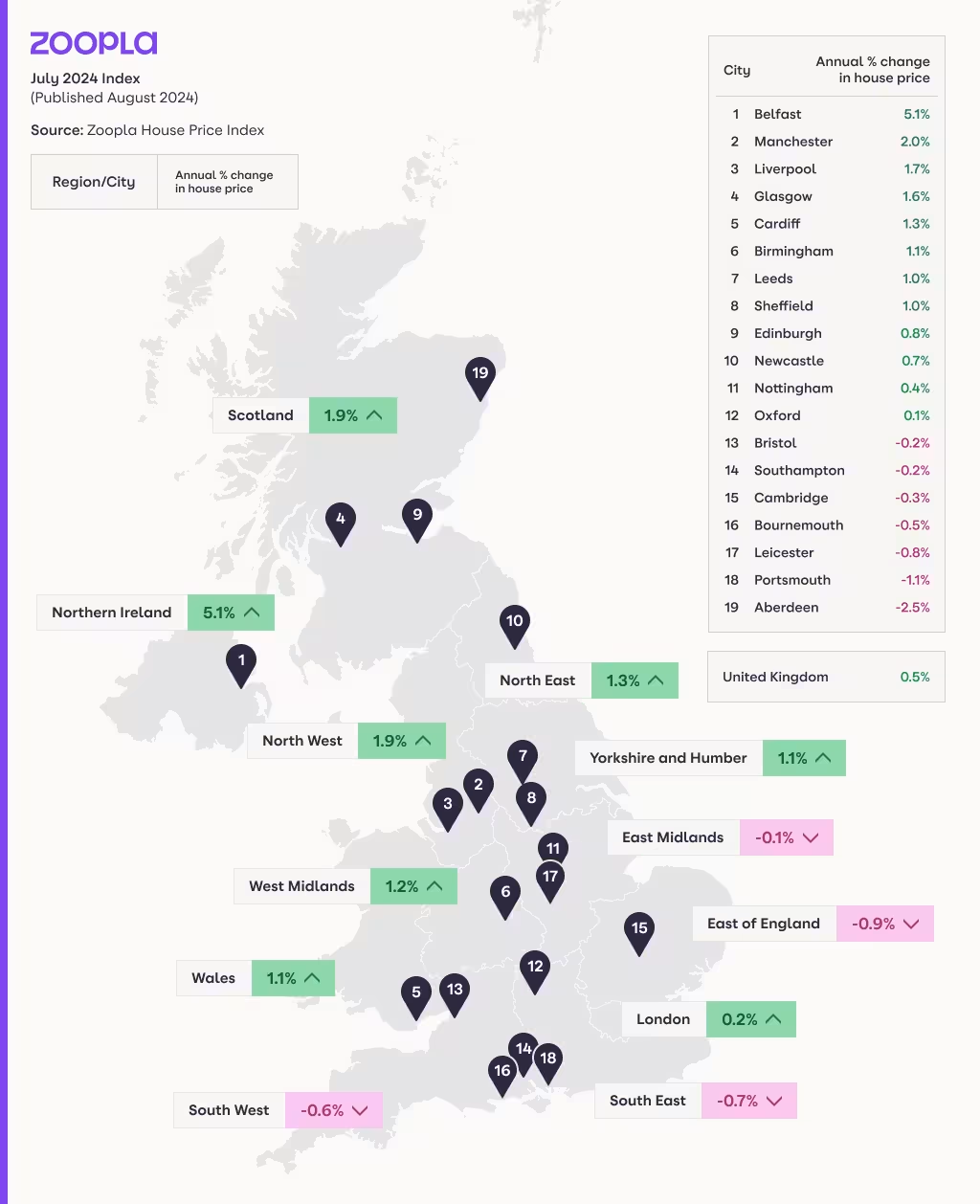

As we move towards the final quarter of 2024, Zoopla’s House Price Index Aug 2024 data has given us some valuable key insights into the performance of the UK housing market to date and in comparison to 2023.

We’ve pulled out some of the key takeaways below and click here to download the full report

- House prices - at the end of August 2024 house prices have risen by 1.4% from 2023, with a predicted 2.5% rise for the whole year and 1.1 million sales in total. The average UK house price was £266,400 in July 2024.

- Mortgage rates have fallen to an average of 4.5% for a 5-year fixed rate at 75% loan-to-value, despite an August base rate cut, not many banks have adjusted their rates yet/ offered new deals. Zoopla’s view is that average mortgage rates will remain above 4%, which should provide good momentum for the housing market.

- All areas of market activity are up year-on-year – thanks to more confident consumers and a growing economy. It's a good time in the housing market, with more sellers and buyers coming in, making things more balanced than they've been in the last 5 years.

- Housing Stock - Sellers are putting homes on the market faster than usual, with many of them also looking to buy. Sales are increasing, and the number of homes for sale is at a 7-year high, giving buyers plenty of options.

- Pricing matters – one in five homes has had their asking price slashed by 5% or more, showing that buyers have bargaining power. It takes 28 days to sell a home with no asking price reduction, but 73 days if you overprice and then need to reduce by 5% or more.

House price drop in South West and Bristol vs 2023

As we can see from the Zoopla chart below, as of July 2024, Bristol has had a -0.2% drop in house prices in comparison to 2023, we can see that the whole of the South West had a drop in fact, with the region having -0.6% drop vs 2023.

These small falls perhaps indicate that the Bristol market, whilst always buoyant, is adjusting to the impact of higher borrowing costs. Additionally, it could be there is also a greater supply of property vs 2023, as 29% of Bristol homes are privately rented (2022) which is greater than the national average of 20%.

Is the Renters’ Reform Bill having an impact?

The upcoming (and long-awaited) Renters' Reform Bill, expected to come into effect later this year, will bring significant changes as this bill aims to abolish Section 21 ‘no-fault’ evictions, strengthen tenants' rights, and improve the quality of rented accommodation, and data suggests many landlords are selling up, with some blaming uncertainty caused by government delays to renting reforms. A 2024 survey by the National Residential Landlords Association (NRLA) found almost a third of landlords plan to reduce their rental portfolios and only 9% say they are likely to grow them.

Need Conveyancing?

When you sell or buy a property with us we will ask for your property conveyancer/solicitor details.

We can recommend good local agents, contact us for more information

How Much is Your Property Worth?

Not sure how much your property is worth? Request a free, no obligation valuation for your property.

Book a Valuation